EU 4th Anti-Money Laundering Directive – Are You Prepared?

Back in June, we discussed what was due to change with the introduction of the 4th EU Anti-Money Laundering Directive (EU4MLD) – the latest revisions to the anti-money laundering directive.

The clock is now ticking as to when the full changes will come into effect and as the introduction of heavier penalisation and seven figure fines emphasise the gravitas of the situation, we take a look at what’s changing and how you can ensure you stay compliant.

Is It Really As Complicated As It All Sounds?

Short answer: No.

The newly heightened penalties and fines are pretty daunting but they are not there to catch people out.

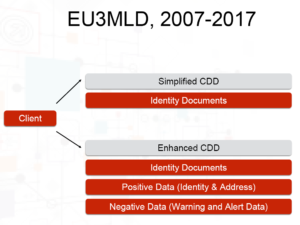

Ten years ago the rules for due diligence were tightened with the introduction of the EU3MLD. The need for more scrupulous security checks was further emphasised with the first revision of EU4MLD but people simply did not comply, choosing to continue with the basic method of requesting a personal document and hoping that would be sufficient.

Unfortunately, relying solely on this method of basic due diligence is not enough to protect against fraud. The need for companies to improve their procedures has been reviewed with the aim to stop money-laundering crimes going on to support terrorism and cyber theft.

Is It Essential I do The Searches Electronically?

No, completing these searches electronically is not essential but will save you time, effort, resources and considerable labour hours. An electronic anti-money laundering search will ensure you are compliant with the minimum of fuss.

“It is important that all firms, regardless of their size, conduct a firm-wide money-laundering risk assessment to ensure they are aware of the specific risks relating to the services they undertake and a thorough risk assessment of any clients requesting legal services”

The Law Society

AML Search – the leading company in electronic anti-money laundering consistently checks client’s personal data against over 130 territories and their non-personal data against over 130million companies to ensure your firm stays as compliant as possible.

So, what has changed in terms of ordering searches?

Quite a bit but the good news? You’ll barely notice. AML Search takes care of all the back-end details. The firm simply enters the client’s details and the intelligent system does the rest.

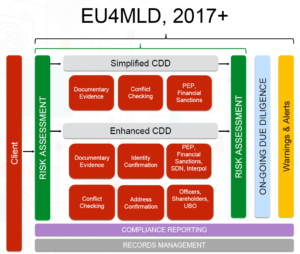

EU4MLD requires firms to assess whether the client in question would need a simple or enhanced due diligence check. This is assessed with a risk assessment.

Reducing Risk

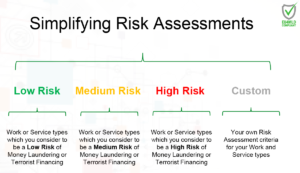

Previous AML searches required the firm to rate the client’s possible risk factor on a numerical scale. This method was vague and ambiguous. AML Search now uses a new, more accurate method which allows the firm to chose one of four risk assessment categories.

This simple search concludes if the client requires an enhanced due diligence check or if the standard search will be sufficient. This method helps to easily differentiate between an elderly customer who has been a client for several decades and may have picked up a parking ticket and an unknown foreign national who is looking to purchase a string of new properties.

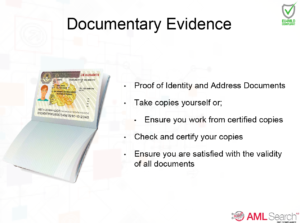

If the risk assessment calls for a Simplified Due Diligence the system will request a few basic details plus the usual documentary evidence and run the search.

If the initial risk assessment calls for an enhanced due diligence search the system will still request basic information and documentary evidence but will compare the client’s details against sanctions, warning lists and PEP’s (politically exposed person list).

“Robust anti-money-laundering arrangements are important and a priority for the sector, law firms and the global economy.“

“We expect law firms to comply with their legal obligations and are urging law firms to familiarise themselves with the new regulations as soon as possible, and take action to comply.”

Solicitors Regulation Authority

Previously under 4AMLD companies were required to incorporate an in-house money laundering reporting officer (MLRO). This has been revised and proposed that companies can, if they choose, designate a senior person within the company to carry the responsibility of ensuring the business is compliant with the rules stated within EU4MLD.

If a risk assessment returns as non-compliant AML Search includes the ability to resolve the case via their management section. Here the MLRO or person of authority can log in, discover the issue and resolve it there and then with the necessary additional information or documentation.

Data Protection

With the law and the penalty structure changing to include the protection of client’s data, AML Search has devised a service whereby the system conveniently stores an AML search and sends the firm an automatic alert if a client’s status changes. For example: if the client were to appear on the PEP overnight the system will alert the firm as to this change, ensuring your information is always up to date and as current as possible.

This alert system also notifies the firm when a client’s data has become out of date, ie: passport/driver’s license, and also sends an advisory message when the client’s data is coming up to the five-year storage limit. The data will only not be automatically deleted if the firm’s administrator logs in and proves the client is still an active customer.

Once the information has been deleted the firm will receive a certificate verifying that the company actioned a full AML trail.

Firms are no longer permitted to keep hard copies of any client information. Failure to comply with this law will result in large fines for each individual piece of data.

Compliance Reporting

A large change in the EU4MLD is compliance reporting. The SRA and police are entitled to request evidence that an AML search has been undertaken for any client who has used the firm and they expect it within 48 hours. AML Search securely stores all necessary data and are able to produce a certificate if compliance reported is needed, eliminating a possibly expensive, time-consuming and complex procedure.

On-Going Due Diligence

Firms are required to continue monitoring clients to ensure continued due diligence is compliant with the life of the client-firm relationship. This can be an expensive and time-consuming process and requires considerate labour hours and resources to maintain.

Fortunately, AML Search has developed a revolutionary ‘living system’. A specially designed algorithm consistently compares the client’s information with the system’s live database for the lifetime of the account.

What can happen if I don’t comply?

The new directive is all about minimising risk. If you chose to ignore the new legislation you could find yourself with a fine of up to £1,000,000 and a jail sentence of 7 years. The terms of these fines are defined as: where ‘…the person has breached a prohibition or failed to comply with an obligation, that is imposed by or under financial sanctions legislation,’ (s.146 ‘Policing and Crime Act 2017).

“Compliance with money-laundering obligations is one of the greatest challenges for solicitors in the UK today”

Ensure You’re Covered

If your business is covered by the Money Laundering Regulations then give Pali a call. Our friendly staff will be more than happy to help you get started with AML checks. The results, from AML Search – the leading money laundering experts, are instant and accurate and as we have incorporated a direct link to their system you can now order your Anti-Money Laundering Searches online through the regular Pali system at the same time as any other searches you require.